How To Use Tax Adjustment In QuickBooks?

Are you trying to know about the tax adjustments and its use in your QuickBooks accounting software? These are transactions which are provided to adjust the amount in the “Tax Payable” account to arrive at the correct tax liability that requires to be paid to the tax agency.

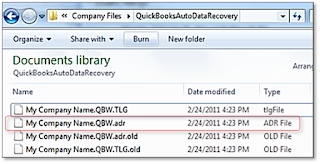

The default tax agencies created by QB contain input & output tax in the “Charts of Accounts”. So when a user types an invoice, Output tax account is credited. While entering a bill Input tax account gets debited before making payment at the end, the user will make a tax adjustment entry to offset the amounts in Input & Output tax account. With the help of QuickBooks File Repair Center, you can learn to transfer their difference to the Tax Payable account.

Make tax adjustments in QuickBooks: To provide a tax adjustment, follow these

- On the left side of the screen, click Taxes.

- Choose the agency you wish to perform the adjustment for, from the Tax drop-down options. You can alternatively, click the right or left arrows on the carousel to choose the relevant agency.

Now perform the GST steps:

- Under Open, in the Returns section, find the period for which you wish to enter the adjustment. This section would usually show the duration which the adjustment is to be entered.

- Click Tax Adjustment in the Action column.

- Now you will see a journal entry form. Provide Input, Output & Payable accounts for CGST, SGST, and IGST & then save the adjustment.

To perform VAT & CST:

- Under Open in the Return Section, find the period for which you wish to enter the adjustment. It will again show the duration.

- Go to the Tax adjustment option in the Action column.

- For VAT & cat agency, one you click tax adjustments, you will see Journal-page appearing where input Tax, Output Tax, and Tax payable accounts are automatically populated with the amount.

- Ensure if the amounts & the accounts are correct. Check with your accountant/chartered accountant and verify the numbers.

Once the numbers are correct hit the Save & Close button and then save the adjustment transaction.

Four further info regarding making adjustments in service tax & recording payment, you can contact QuickBooks Repair Service Center by dialling our helpline number+61-283173394. Our team will help you in resolving any issue with ease & comfort.